Secure your future with the shield of comprehensive general insurance.

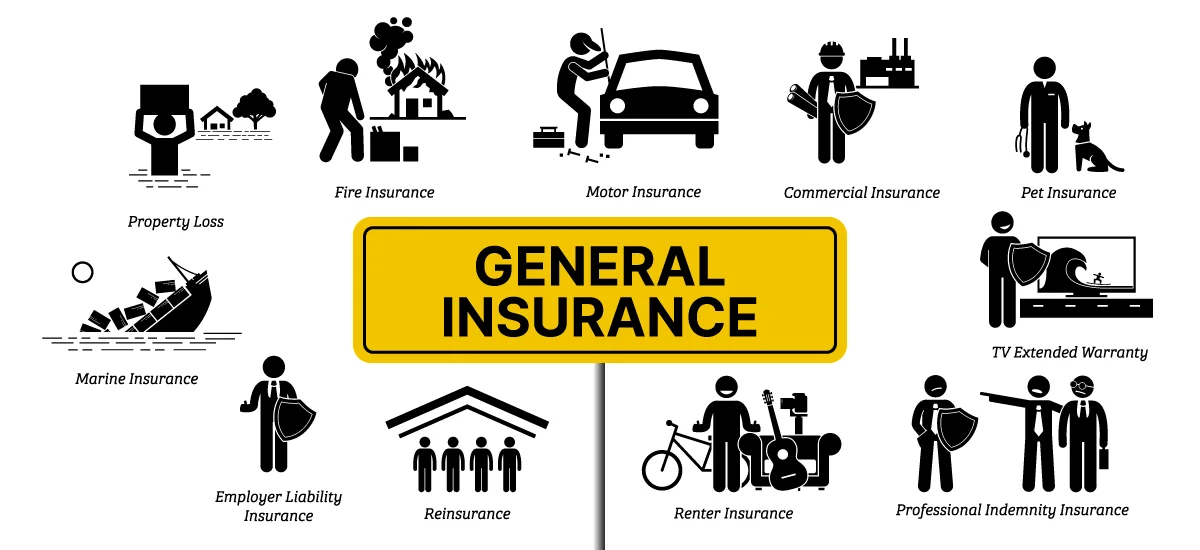

General insurance, also known as non-life insurance, is a type of insurance that provides coverage for individuals, businesses, and organizations against various risks and liabilities. Unlike life insurance, which focuses on providing protection in the event of the insured person's death, general insurance covers a wide range of non-life-related risks.

General insurance policies offer financial compensation or reimbursement for losses or damages that occur due to specific events or circumstances. These events can include accidents, property damage, theft, liability claims, natural disasters, medical expenses, travel mishaps, and more.

Mediclaim

A mediclaim policy, also known as health insurance, is a type of insurance policy that provides coverage for medical expenses incurred by the policyholder due to illness, injury, or hospitalization. It is designed to financially protect individuals and families from the high costs of healthcare services, including hospitalization, medical treatments, and surgical procedures.

Mediclaim policy planning is essential as it ensures access to quality healthcare without the worry of exorbitant medical expenses. It offers financial support during medical emergencies and routine healthcare needs, promoting timely medical attention and better health outcomes.

Without proper mediclaim policy planning, individuals may face the risk of significant financial strain if they encounter medical emergencies or require prolonged medical treatments. High medical bills can deplete savings and lead to additional stress during already challenging times.

By proactively including mediclaim policy planning in their overall financial strategy, individuals can safeguard their health and finances. It provides a safety net against unexpected medical costs, giving peace of mind and the ability to focus on recovery without worrying about the financial burden. Choosing the right mediclaim policy, tailored to specific health needs and budget, requires careful consideration and professional advice from insurance experts to make informed decisions.

2-Wheel / 4-Wheel Insurance

Two-wheel and four-wheel motor policies are types of insurance that provide coverage for vehicles like motorcycles and cars, respectively. These insurance policies are designed to protect vehicle owners from financial losses arising from accidents, theft, or damages to their vehicles. They offer different levels of coverage and benefits based on the type of vehicle and the policyholder's specific needs.

Two-wheel and four-wheel motor policy planning is essential as it ensures that vehicle owners comply with legal requirements and are financially protected in case of unfortunate incidents. These policies cover repair costs, third-party liabilities, and even personal injury expenses, reducing the financial burden that can arise from unexpected accidents or theft.

Without proper two-wheel and four-wheel motor policy planning, vehicle owners risk facing significant financial losses. Repairing or replacing a damaged vehicle can be costly, and in case of accidents causing injury to others, the liability for medical expenses and legal claims can be substantial.

By incorporating two-wheel and four-wheel motor policy planning into their overall financial strategy, vehicle owners can have peace of mind while on the road. Having the appropriate coverage ensures financial protection, quick access to repairs, and the ability to handle legal obligations if involved in accidents. Consulting with insurance experts can help vehicle owners find the right motor policy that matches their needs, budget, and vehicle type, thus offering comprehensive protection and financial security.

Income Loss Planning

Income loss planning, also known as personal accident insurance, is a type of insurance policy that provides financial protection in the event of an accident resulting in disability or death. This insurance policy is designed to compensate the policyholder or their beneficiaries for the loss of income or earning capacity caused by the accident.

Income loss planning (personal accident) policy is essential as it offers a safety net against unforeseen accidents that can lead to a loss of income. It provides financial support to the insured or their family during periods of disability, ensuring that essential expenses can still be met.

Without proper income loss planning, individuals may face severe financial hardships if they suffer from an accident that leaves them unable to work. The loss of income can disrupt their financial stability and impact their ability to support themselves and their dependents.

By incorporating income loss planning (personal accident) policy into their financial strategy, individuals can mitigate the financial risks associated with accidents. It ensures that in case of disability or death due to an accident, there is a source of financial support to cover daily living expenses, medical costs, and other financial obligations. Consulting with insurance experts can help individuals find the most suitable income loss policy that aligns with their specific needs and circumstances. This proactive approach provides peace of mind and financial security during challenging times.

Fire Insurance

A fire policy is a type of insurance coverage that protects against financial losses resulting from damages caused by fire to insured property. It provides compensation for the repair or replacement of damaged assets, such as buildings, contents, and inventory, due to fire-related incidents.

Fire policy planning is essential as it safeguards property owners and businesses from the devastating consequences of fire accidents. It helps mitigate the financial impact of property damage, ensuring that individuals or businesses can recover and resume normal operations more quickly.

Without proper fire policy planning, property owners and businesses may face severe financial setbacks in the event of a fire. Rebuilding or repairing the damaged property could be financially overwhelming and might even lead to bankruptcy in extreme cases.

By incorporating fire policy planning into their risk management strategy, individuals and businesses can protect their assets and investments. Selecting the appropriate coverage and insured amount, based on the property's value and potential risks, is crucial to ensure adequate protection. Consulting with insurance experts can assist in tailoring the fire policy to specific needs and circumstances, offering peace of mind and financial security in the face of fire-related emergencies.

Property insurance

Property insurance policy is a type of insurance coverage that provides protection for physical properties, such as homes, buildings, and personal belongings, against damages or losses caused by various perils, including fire, theft, vandalism, and natural disasters. It helps property owners mitigate financial risks and recover from potential damages to their assets.

Property insurance planning is essential as it safeguards one's investment in real estate and personal possessions. Whether it's a home, business property, or valuable belongings, having property insurance offers peace of mind and financial security against unforeseen events that could otherwise result in substantial financial losses.

Without proper property insurance planning, property owners may face significant financial hardships if their properties are damaged or destroyed due to covered perils. Recovering from property-related losses can be financially burdensome and even lead to potential bankruptcy.

By including property insurance planning in their overall risk management strategy, individuals and businesses can protect their assets and investments. Choosing the right property insurance policy, tailored to specific property types and potential risks, requires careful evaluation and professional advice from insurance experts to ensure comprehensive coverage and adequate protection.

Contractor All Risk

A Contractor All Risk

policy is a type of insurance policy designed to provide comprehensive coverage for construction and infrastructure projects. It offers protection against various risks that can arise during the construction process, such as damage to the project site, materials, equipment, and third-party liabilities.

CAR policy planning is essential for construction companies and contractors as it helps mitigate financial risks associated with construction projects. It covers unforeseen events like natural disasters, fire, theft, and accidental damage, ensuring that the project can proceed smoothly without significant financial setbacks.

Without proper CAR policy planning, construction companies and contractors may face significant financial losses if unforeseen events occur during the project. Repairing damages, replacing stolen equipment, or dealing with third-party claims can be financially burdensome and may lead to delays or even project abandonment.

By incorporating CAR policy planning into their project management strategy, construction companies and contractors can protect their investments and ensure the successful completion of projects. It provides financial security and peace of mind, allowing them to focus on delivering quality construction without worrying about potential risks. Consulting with insurance experts and tailoring the CAR policy to the specific needs and scale of the project can ensure comprehensive coverage and effective risk management.

Doctor Indemnity Insurance

An indemnity policy for doctors, commonly known as medical malpractice insurance, is a specialized insurance product that provides coverage to healthcare professionals against claims of negligence or errors resulting in patient harm. It is designed to protect doctors and medical practitioners from legal and financial liabilities arising from medical malpractice allegations.

Indemnity policy planning for doctors is essential as it safeguards their professional reputation and financial stability. In the healthcare industry, mistakes and adverse outcomes can occur, even with the best intentions and efforts. Medical malpractice claims can lead to expensive lawsuits, settlement costs, and damage awards, which can be financially devastating without appropriate insurance coverage.

Without proper indemnity policy planning, doctors may be exposed to significant legal and financial risks. In the absence of insurance protection, they could face personal liability, putting their assets and livelihood at stake in the event of a malpractice lawsuit.

By obtaining an indemnity policy tailored to their medical specialty and scope of practice, doctors can protect themselves from potential claims and legal challenges. A well-chosen policy ensures that doctors can focus on delivering high-quality patient care without constant worries about the threat of lawsuits. Seeking advice from insurance experts and understanding the policy's coverage details are crucial steps to make informed decisions about the right indemnity policy for individual needs and circumstances.